Financial growth is crucial to any given organization. Many make the bigger buck, while many also struggle in the same process. In between lies the strategies used by a company to maximize its profits. Financial Planning and Analysis (FP&A) can help boost a company’s revenue and engage in the right direction. We delve on the new Digital FPA world and Budget Planning FPA.

What is Financial planning and analysis (FP&A)?

Financial planning and analysis (FP&A) are how organizations produce budgets, forecasts, analyze profitability, and otherwise advise senior management decisions about how to most effectively and efficiently implement the company’s strategy. Individuals or teams can perform the FP&A functions, report to the chief financial officer, and work alongside other finance professionals such as the controller and treasurer (CFO). While many professionals with accounting experience conduct FP&A, it varies from accounting in that it focuses on forward-looking data rather than historical data.

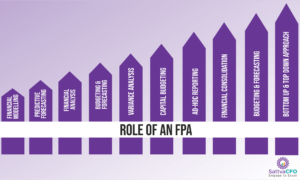

What is the role of an FPA Team?

Through analysis, financial predictions (planning, budgeting, and forecasting), and reporting, a newly qualified FPA expert delivers insights into an organization’s financial decision-making process. They can engage as a part of a team of financial analysts, but they can also operate independently. They have a thorough understanding of the entire decision-making process and can contribute to and take responsibility for specific steps. They can accurately and efficiently accomplish these duties, recognize, appraise, and adjust their processes to changes in the corporate environment. Professional conduct standards are understood and followed by FPA employees.

Through analysis, financial predictions (planning, budgeting, and forecasting), and reporting, a newly qualified FPA expert delivers insights into an organization’s financial decision-making process. They can engage as a part of a team of financial analysts, but they can also operate independently. They have a thorough understanding of the entire decision-making process and can contribute to and take responsibility for specific steps. They can accurately and efficiently accomplish these duties, recognize, appraise, and adjust their processes to changes in the corporate environment. Professional conduct standards are understood and followed by FPA employees.

Financial Modelling

Financial modeling is an essential tool for predicting corporate performance, budgeting, asset management, and cash flow analysis. Financial modeling is used by research analysts, investment bankers, accountants, and entrepreneurs to better evaluate a company’s performance before making critical business choices. Financial models are created with MS Excel and may assist you with various activities, including projecting business performance, budgeting, asset management, and cash flow analysis. Financial modeling necessitates a sharp sense of numbers and statistics to generate the best financial reports for yourself or your clients.

Predictive Forecasting

While it is blurry to forecast the future, understanding how the market and consumer trends will grow is critical for brands and businesses in all industries. First, this is because consumers are an essential aspect of any brand’s success and growth. Second, this is because brands and customers are both crucial components of the market ecology. To fully comprehend this ecosystem, a thorough market analysis is required. On the one hand, this predictive analysis will help you better understand your target audience, and on the other hand, it will increase and boost brand connect.

Financial Analysis

Financial analysis is a part of the entire business finance function that entails looking at past data to learn about a company’s current and future financial health. Financial analysis can provide business managers with the knowledge they need to make critical decisions in several settings. First, any business manager must be able to comprehend financial information. The language of business is finance. Business goals and objectives are set in monetary terms, and the results of those goals and objectives are measured in financial terms.

Budgeting & Forecasting

Corporations use budgeting and financial forecasting to create a plan for where management needs to take the company (budgeting) and whether this is on the right track (financial forecasting). Although budgeting and financial forecasting are used interchangeably, the two ideas are different. Financial forecasting forecasts the amount of revenue that will be achieved for some time. In contrast, budgeting quantifies the anticipation of revenue that a corporation wishes to attain for a future time.

Variance Analysis

Variance analysis is a financial tool for determining the disparity between budget estimates and actual figures. It’s a quantitative way of keeping a corporation under better management. One best practice is to plot variances on a trend line when utilizing variance analysis to identify any significant movements quickly. Once you’ve found anything suspicious, variance analysis can help you figure out why there’s such a substantial gap between what was intended and what transpired financially. You can total all deviations during a reporting period to evaluate if your company is over-or under-performing.

Zero Based Budgeting

In management accounting, zero-based budgeting entails creating the budget from the ground up. It entails re-evaluating each line item on the cash flow statement and justifying all of the department’s planned expenditures. As a result, zero-based budgeting is defined as a method of budgeting. All expenses for the new phase are determined based on actual costs to be incurred rather than on a differential basis, which entails simply changing the expenses incurred to account for changes in operational activity. Every activity must be justified under this strategy, explaining each cost’s revenue for the organization.

Capital Budgeting

Rather than accounting revenues and expenditure flowing from the investment, capital budgeting includes tracking cash inflows and outflows. Thus, non-expense items like principal loan payments, for example, are accounted for in capital planning because they are cash flow transactions. Non-cash expenses like depreciation, on the other hand, are excluded from capital budgeting because they are not cash transactions. Instead, the study includes the cash flow expenses connected with the actual purchase and financing of a capital item.

Adhoc reporting

Ad hoc analysis allows a user to derive insights from a smaller set of data on an as-needed basis to respond to a specific business question. Ad hoc analysis is a quick way to get insights when you need them, rather than waiting for a scheduled report.

Financial Consolidation

Financial consolidation, in accounting terms, is the process of integrating financial data from numerous subsidiaries or business entities within an organization and reporting it to a parent firm. Specific computations and consolidation adjustments are made as the figures are combined from the subsidiary level to the parent company level in financial consolidation.

Bottom-up & Top-down Approach

The top-down strategy focuses on higher-ranking officials to set broader goals that will trickle down to lower-level employees’ duties. On the other hand, the bottom-up communication method involves a decision-making process that involves all employees in the company’s goals. As employees fulfill their objectives, each task remains changeable. Companies that use both top-down and bottom-up management methods gain considerable benefits. Both management approaches distinguish between high-level and low-level activity, but how each manages this process differs significantly. As with any business, the aims of each are to think, teach, and gather knowledge appropriately and effectively.

What competencies are a must for Financial Planning and Analysis (FP&A) Team?

The various competencies required are as follows:

- Critical and strategic thinking

- Communication is essential.

- Accounting and finance knowledge on a technical level.

- The ability to think outside the box.

- Anticipating and responding to changing demands.

- The ability to lead.

- Collaboration is important.

FAQ’s on FP&A

FAQ’s on FP&A

What is the ‘New Digital FP&A’ world?

One of the most significant issues for most CFOs and FP&A teams is time management. There isn’t enough of it to get everything done. A finance job can be repetitive in specific ways. These chores, while necessary, may provide minimal value and may include things like bank reconciliation and checking variances between budgets and actuals. It’s also time you’re not spending on being a business partner for the organization and assisting departments with management, control, risk, and funding to help them reach their goals. Thus, with an AI-based system, the future of FP&A looks promising. New Digital FPA

We are an early-stage startup; do we need FPA?

It is essential to find a methodology to stabilize your proceedings than to hire the costliest team that might prove fatal when you start. Recognition and statistics will decide if you need much more in-depth planning in the future.

Is the role of the FPA team is Super Important for our Company?

Yes, it is essential since it takes special knowledge and constant surveillance of the flows in an organization. Moreover, such processes take a team who would dedicate their time and knowledge towards better predictions.

How can SattvaCFO support Financial planning and analysis (FP&A)?

Our firm SattvaCFO has been involved in the analysis of many top-tier organizations. With the element of human understanding and technical accuracy, SattvaCFO strategies can deem benefits.

SattvaCFO supports deploy FP&A resources and execute FP&A in your organization. Please connect with us.

Also read