What is Budgeting?

Budgeting is the process of projecting revenues and expenses, cash flows, production lines, working capital requirements, and the same for the next few years, based on certain rationale logic about prospects for the future and previous experiences, and presenting it to the company’s management for decision making. Budgeting & Forecasting. planning budgeting and forecasting.

What is Forecasting?

Financial Forecasting is an essential aspect of business planning that predicts future firm performance based on historical financial performance and present conditions or trends. To put it another way, financial predictions are a tool that firms use to create and achieve goals. Of course, various things can influence the level of confidence you have in your financial forecasts. They are, nevertheless, always useful markers of whether your company is heading in the right direction. Forecasts can be generated weekly, monthly, quarterly, or yearly, depending on the figures being tracked, and can include metrics like sales, expenditure, cost of goods sold, and profits. budget vs forecast.

How to build a Budget?

A budget can assist you in determining and achieving your long-term objectives. A budget forces you to plan out your objectives, save money, track your progress, and turn your aspirations into reality. You’ll know exactly how much money you make, how much money you could spend every month, and how much money you want to save.

What is the purpose of budgeting?

Budgets are created to support the organization’s many functions, such as production planning, human resource management, retail planning, and working capital management. As a result, budgets serve to smooth out the entire purchase-production supply chain.

Another goal of Budgeting is to maintain consistency. Another budget is reliant on the first. Budgets assist various and widely dispersed departments in achieving the organization’s shared aim. It also acts to set departmental target goals and influence departmental efficiency levels to meet budgeted targets.

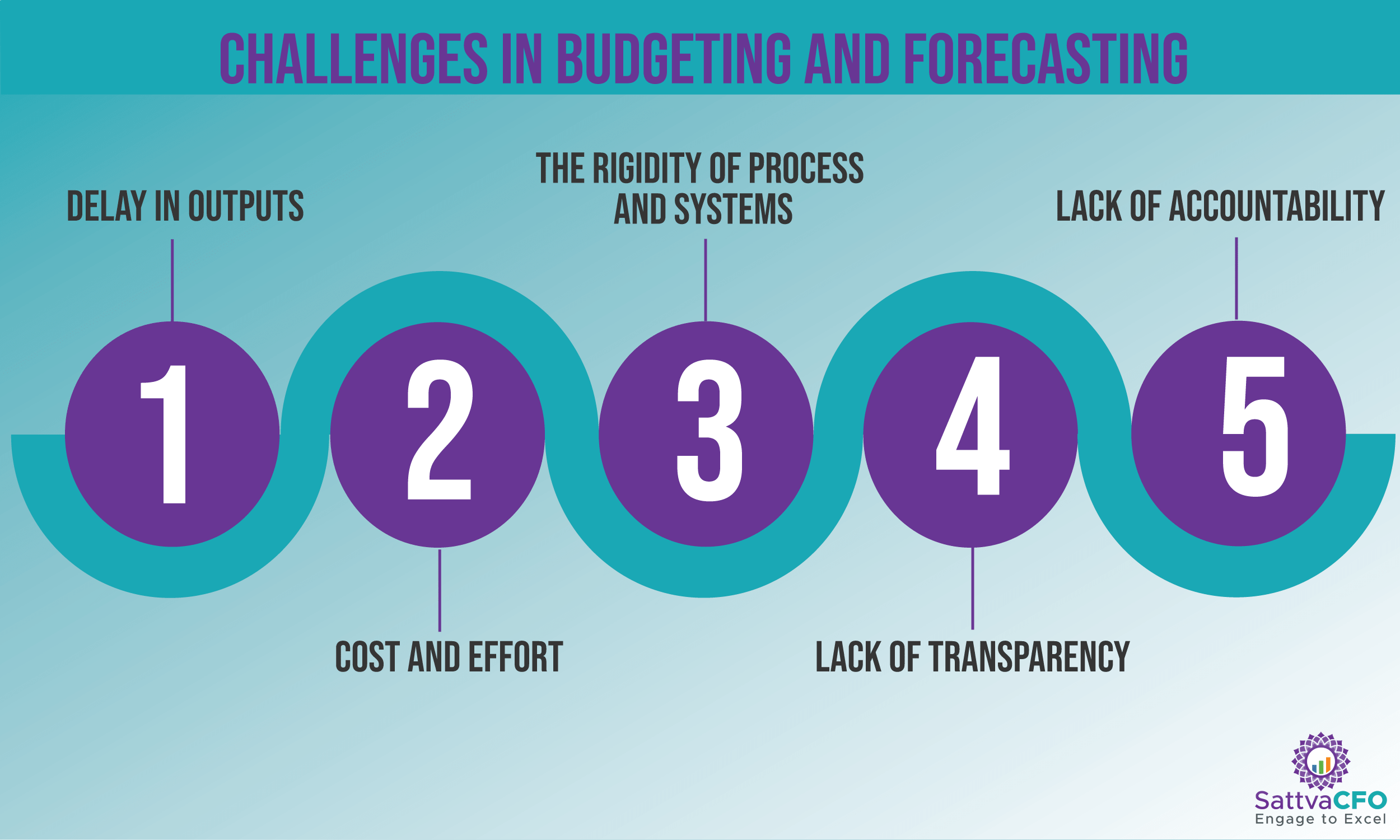

What are the critical Challenges to Budgeting & Forecasting Process?

The process of financial Budgeting and Forecasting frequently takes far too long. Most firms take weeks to create quarterly predictions, and preparing each iteration of forecast or budget takes even longer. After accounting for all of these and additional delays, the outputs are virtually always delayed and irrelevant by the time they are finished. In addition, re-organizations, mergers and acquisitions, and divestitures are not supported by most financial budgeting and forecasting procedures and systems. All of these are pretty common in today’s corporate world. Without the ability to examine these factors, a company will be unable to respond effectively.

A Financial Analyst or FPA Lead in charge of Budgeting and forecasts spends a significant amount of time going back and forth, double-checking that the information is correct. He then devotes even more effort to ensure that everyone inputs data in the most recent version and spotting any unintended errors committed by his or her coworkers.

Organizations are continually battling bottlenecks. Unfortunately, many people aren’t sure what’s causing the delay, who’s to blame, or how to fix it. There is no transparency in the process, especially for those who work with excel spreadsheets. Mistakes are frequently discovered late in the process, leaving little opportunity to correct them.

How to overcome the challenges of the B&P process?

Many of your budgetary issues could be caused by the tool you’re using. Suppose you’re still using Excel spreadsheets to manage your finances. In that case, you’re missing out on a terrific opportunity to use a solution that will not only walk you through the budgeting process but will also use technologies to assist you in assessing your financial results. You should ensure your budgeting software is compatible with the other resources you utilize, in addition to evaluating tools.

What are the best practices in the Budgeting & Forecasting process?

In a B&P process, the following steps are crucial:

- Keep the entire B&P process flexible

- Plan your Budget

- Initiate Rolling Forecasts

- Communicate with all stakeholder

- Collate inputs from the Cross-Functional team

- Involve entire Finance & FPA Team

- Set clear goals about what is driving predictions

- Generate various scenarios.

- Keep the model file lite weight

- Set right strategic priorities

- Ensure final buy-in from concerned stakeholders

- Tracking variances post-budget approval

- Highlight improvement areas

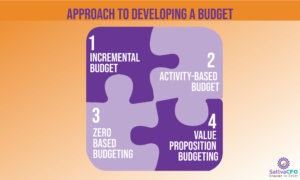

What are the ways to develop a budget?

The critical approach to developing a budget is as follows:

- Incremental Budget

- Activity-Based Budget

- Zero Based Budgeting

- Value proposition Budgeting

FAQ’s on Budgeting & Forecasting

FAQ’s on Budgeting & Forecasting

How vital is Budgeting to an organization?

Budgeting makes up for the systematic cash flow of an organization. When an organization fails to abide by a proper budget, it can only stir in the end. Hence, Budgeting is essential. It is as simple as the structure of your organization. More prominent companies need a much more complex budgeting system, while the commoner requires a much simpler budgeting style of living. Hence, to survive financially at all critical times, Budgeting is essential.

How can SattvaCFO support in Budgeting & Forecasting Process?

Budgeting and Forecasting takes a lot of skill, analysis, and dedication to process an organization’s future. SattvaCFO has been on the line of successfully incorporating a smooth budget analysis and result and providing close to accurate forecasts. However, with the right strategy and report analysis, SattvaCFO never fails.

SattvaCFO can build a budgeting & forecasting exercise for your enterprise.

Also read: