Karnataka PT Payment e-Verification

Profession tax is levied under the Karnataka Tax on Professions, Trades, Callings and Employments Act, 1976. Karnataka PT Payment e-Verification

Profession Tax shall be paid by every person exercising any Profession or calling or is engaged in any trade or holds any appointment, public or private as specified in the Schedule to the Act.

No Professional Tax is payable by persons who have attained age of sixty-five years. Also, no tax is payable for holding any Profession for less than 120 days in that year.

Steps to e-Verify Professional Tax Payment

While filing Professional Tax return, we might get message that the payment is not verified, then we have to follow the following steps:

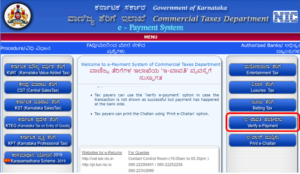

Step-1: Visit e-Payment system of Karnataka Commercial Tax department (VAT). Click here

Step-2: Click on Verify e-Payment tab

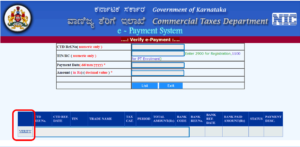

Step-3: Kindly fill the following details

- CTD reference Number from Karnataka Professional Tax Challan retrieved after payment

- Registration Certificate Number of Professional Tax (generally 9 digit numeric)

- Date of Payment of Professional Tax to be retrieved from Challan

- Amount of Professional Tax paid

- Finally, Click on LIST tab

Step-4: Tab will pop up, thereafter click on Verify Tab

Step-5: Finally, you will get message “PAYMENT DONE SUCCESSFULLY”. Now you can file your professional tax return Karnataka PT Payment e-Verification.

Further details relating to Karnataka Professional Tax eVerify Payment challan can be obtained from e-prerana

Also read: