Cost Inflation Index (CII) – Income Tax

Table of Contents

Cost Inflation Index – What is CII & Who notifies CII

‘Cost Inflation Index’ (in short ‘CII’) for any year means such index as the Central Government may, having regard to seventy-five percent of the average rise in the consumer price index for the urban non-manual employees for the immediately previous year to such previous year. cost inflation index cii chart.

Central Government publishes CII by notification in Official Gazette.

CII = 75% x Average rise in Consumer Price Index (CPI) for Urban non-manual employees.

Why CII (Cost Inflation Index) is calculated

CII is calculated to factor the inflation in purchase prices.

Use of CII (Cost Inflation Index) is calculated

CII is used to increase the original purchase price after factoring in inflation as notified by Government in this regard. To benefit the taxpayers, CII benefits are applied to long-term capital assets, to cost price of an asset by factoring inflations, thereby capital gain value is rationalized otherwise, the taxpayer would have to pay higher capital gain tax.

Year-wise CII

The year-wise CII is as follows:

| Financial Year (FY) | Cost Inflation Index – CII |

| 2001-02 | 100 |

| 2002-03 | 105 |

| 2003-04 | 109 |

| 2004-05 | 113 |

| 2005-06 | 117 |

| 2006-07 | 122 |

| 2007-08 | 129 |

| 2008-09 | 137 |

| 2009-10 | 148 |

| 2010-11 | 167 |

| 2011-12 | 184 |

| 2012-13 | 200 |

| 2013-14 | 220 |

| 2014-15 | 240 |

| 2015-16 | 254 |

| 2016-17 | 264 |

| 2017-18 | 272 |

| 2018-19 | 280 |

| 2019-20 | 289 |

| 2020-21 | 301 |

|

2021-22 2022-23 |

317 331 |

Base year in Cost Inflation Index

Base Year is the first year of the Cost Inflation Index ie FY 2001-02 is 100. The index of all years is compared to the base year in order to find the increase in inflation.

Latest Cost Inflation Index for FY 2022-23 / AY 2023-24

The Cost Inflation Index (CII) for AY 2023-24 / FY 2022-23 is 331.

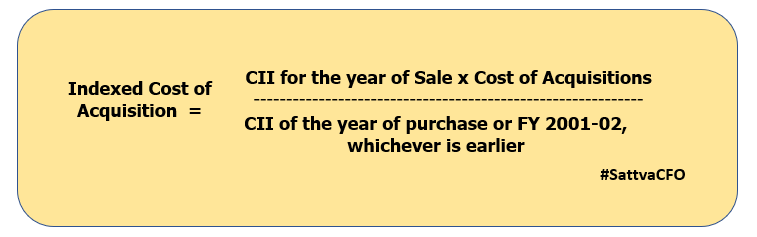

How indexed cost of acquisition is calculated?

Indexed cost of acquisition is calculated by the following formulae:

Cost Inflation Index from Financial Year 2001-02 to 2021-22

SattvaCFO provides Management Reporting and Business Plan Preparation services. Please contact us to avail these services.

Also read:

- Cost Management & Profit Maximization

- Track Key Investors Metrics for your Startup

- 5 Key Metrics Startup must track