How to generate Karnataka Profession Tax Challan without CTD Reference Number

Table of Contents

Karnataka Profession Tax

In the state of Karnataka, Profession Tax is levied under the “Karnataka Tax on Professions, Trades, Callings and Employments Act, 1976 (hereinafter referred to as ‘Act’).” Generate Challan without CTD Reference No

Profession tax has to be paid by every person carrying on any Trade, callings or rendering professional services as per rates specified in the schedule to the act.

Challan CTD reference number

After payment of challans, the system generates ‘Commercial Tax

Department Reference number’ (also called as ‘CTD Ref. No.’). This is a unique number for each payment made to the tax department. Further, CTD reference number is helpful for future reference in order to generate challan, or offset the payment against the return.

Steps to generate Karnataka Profession Tax Challan without CTD Reference Number

The following steps can be followed to generate Karnataka Profession Tax challan even without CTD reference number:

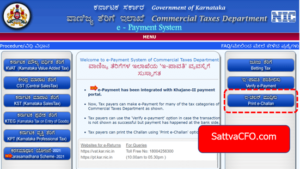

Step-1: Visit website of Commercial Tax Department, e-payment system, Click_VAT-KAR

Step-2: Fill up either Registration Certificate (RC) Number or TIN number or CTD reference number, if available. Also, fill up payment date (in dd/mm/yyyy format) and Amount in Rupees. Click on ‘Challan Print’.

Step-2: Fill up either Registration Certificate (RC) Number or TIN number or CTD reference number, if available. Also, fill up payment date (in dd/mm/yyyy format) and Amount in Rupees. Click on ‘Challan Print’.

Step-3: The following box will pop up. Please check on ‘pdf print’ to retrieve challan.

The challan (form 152, see rule 50(1)(a) will contain necessary details as follows:

- Major head of account

- Date

- Payment Gateway

- Remitter’s RC

- PTO

- Name

- CTD Reference number

- KII Ref no

- Period

- Head of account

- Amount

Customer Care details of Karnataka Profession Tax

In case e-challan print option is showing as “no record found”, then the taxpayer has to contact Karnataka Professional Tax Customer Care Department

FAQ relating to e-payment

What is ‘Print e-Challan’ option in the menu?

Use ‘Print e-Challan’ to print the challan for the successful transaction of e-payment relating to Karnataka tax payment.

Can I make payment for the same CTD Reference number generated earlier but payment status shown as failed?

No, there is no such facility to make payment for the earlier CTD reference number. User has to enter the transaction details again, generate the new CTD reference number and make the payment.

If my Account gets debited more than once for the same CTD Reference number then what should I do?

During the transaction period, if the bank’s site encountered any problem, there would be a rare chances of debiting your account twice against a single CTD Reference no. Under such circumstances check the status of your transaction by using the ‘Verify e-Payment’ option available on the main page of e-payment website. Even if your account has been debited twice against a single CTD Ref No., the e-Payment website would display only one successful payment. It may please be noted that the amount which has been debited twice to the dealer’s account has been remitted by the bank to the Government’s account through RBI, you can claim the refund of one such amounts debited twice by the bank from the jurisdictional LVO/VSO/PTO/LTO/ETO. The said authority shall refund the amount within 3-4 days from the date of claiming the refund.

How secure is the transmission of data from the CTD website to the Bank’s website and vice versa for e- payment?

The transmission of data from the Commercial Tax e-Payment website to the bank’s website is encrypted and authenticated with Secure Socket Layer (SSL) authentication. With respect to the banks, all banks providing e-Payment facility have taken adequate security measures as per the guidelines of RBI. Therefore the e-Payment system of Commercial Taxes Department Karnataka is fully secured and safe.

Also read: