You probably can’t afford to hire a full-time chief financial officer if you run a startup or a small to mid-size business. Still, you do need some level of financial assistance from an expert, someone who can keep an eye on your cash flow, margins, key performance indicators, and overall profit picture. At the same time, you focus on your team, products, and growth strategies. Interim CFO Services. interim cfo consulting services.

What are Interim CFO Services?

Interim CFOs are financial management-level professionals with the expertise you require. They may work a full-time job for you, but only temporarily. Alternatively, according to your requirements, they may work part-time. An interim CFO is, by nature, a transitory member of your company, and your expectation for their performance may differ from those for regular employees.

In most cases, an interim CFO does not work with startups. Middle-market corporations are more inclined to hire someone full-time for a minimal, defined amount of time. There is usually a catalyst, something terrible happening to the company’s financial health. When things are going well, companies don’t usually hire an interim CFO.

What do Interim CFO services offer?

Interim CFOs are frequently employed to bridge the gap between full-time CFOs, such as when a company loses its CFO unexpectedly due to death, disability, or firing. Furthermore, many private-equity CFOs make a career of traveling from company to company at several-year intervals. If your firm has had a CFO resign and the new employee isn’t ready to start for a few months, a contract CFO can monitor the finances in the interim. Another reason your company might wish to hire an interim CFO is to benefit from his or her unique experience, such as system implementation, mergers, and acquisitions, or restructuring if the firm goes bankrupt.

In addition to responsibilities such as preparing yearly financial statements, cost accounting and control, liquidity planning and sourcing, working capital management, and administrative area organization, the interim CFO serves as a formal partner in all industry sectors, driving with “out-of-the-box” thought process and a practical “hands-on” mindset, continuously advancing with external partners like as Auditors, Chartered Accountants, equity investors, and banks can also approach the Interim Manager CFO as a qualified contact person on an equal basis.

An Interim CFO could help eliminate the various tight situations that a company might be in. An Interim CFO can provide multiple solutions and activities that are entitled to an average CFO. The only options that an interim CFO can provide are the flexibility and immediate action that an organization needs.

How should an interim CFO function?

An interim CFO should have solid technological abilities and a thorough understanding of your company and market. Based on your knowledge of their abilities, you may opt to promote somebody from within your firm. You can also choose a candidate whom a search firm has recommended. Professional firms attempt to match candidates’ capabilities to your requirements. In either case, you’ll want someone who has worked in a firm your size before and knows how to manage funds. If you have subsidiaries or international activities, your interim CFO will need to be familiar with those as too.

From a financial standpoint, an Interim CFO, whether temporary or permanent, must grasp your company’s vision and long-term ambitions. Do they comprehend how the products or services you offer contribute to your company’s long-term success? Do they have any suggestions for making things better? How does the interim CFO intend to improve your company’s financial health? What kind of strategic advice do they provide? Expect specific responses.

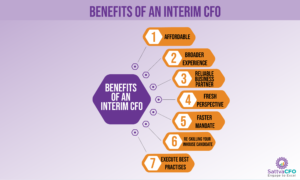

What are the benefits of an Interim CFO?

What are the benefits of an Interim CFO?

Employing an interim CFO is much less expensive than hiring the wrong “in-house” candidate. You won’t have to commit to a full-time salary, nor will you have to discuss company stock or other perks and bonuses that come with keeping an in-house CFO happy and motivated.

- Interim CFOs are typically more driven by the labor required at a startup, such as laying the groundwork for a strong foundation.

- They’ve been taught to create accounting and reporting systems to help owners and managers keep on goal and schedule.

- Interim CFOs have worked with various companies and have the depth of knowledge and expertise that other candidates may lack.

- They are familiar with rules, GAAP best practices, and implementing all of the necessary rights policies and processes from the start.

What are the benefits of CFO services from SattvaCFO?

SattvaCFO engages closely with the client as their strategic business partner. With a full-fledged system that organizes your data and designs that provide accurate results, SattvaCFO ensures that clients know their best move in the industry for better performance. We believe in the value of relationships and long-lasting partnerships. The exceptional standards and internal control procedures at SattvaCFO ensure safety to client records.

SattvaCFO provides Interim CFO Services on a faster mandate. Please contact us for Interim CFO.