National Pension Scheme – Open NPS Account

Table of Contents

What is National Pension Scheme (NPS)?

The National Pension Scheme (NPS) is a government-sponsored state welfare scheme. The program encourages employees to invest in a pension fund at periodic intervals throughout their careers. After retiring, members can withdraw a portion of the fund. If you have an NPS account, you will get the remaining amount as a monthly pension once you retire. Also, articles talks about National Pension Scheme – Open NPS Account, How to open NPS Account Online and Offline.

How to open NPS Account online (Online Registration Process)

1. Make a list of everything you need and keep it ready

- Aadhaar or PAN is a unique identification number. PAN must be connected to a bank account, and Aadhaar must have a current address and cellphone number.

- Debit or credit card, as well as net banking.

- Photograph in passport size (4-12 kb)

- Scanned signature image (12 kb).

2. Go to the NPS Trust website

2. Go to the NPS Trust website

( enps.nsdl.com/eNPS/NationalPensionSystem.html ) and fill out the form.

Select ‘Individual’ from the registration drop-down menu.

3. Provide your Aadhaar or PAN number.

3. Provide your Aadhaar or PAN number.

For verification, an OTP will be issued to the registered cellphone number.

4. Select the account type

4. Select the account type

Begin by creating a Tier I account. Tier II is also an option if you want to invest for other reasons.

5. Enter the OTP (one-time password) for authentication.

Simple OTP authentication is required if you choose Aadhaar. When you use your PAN, your bank will verify your information and charge you Rs 125.

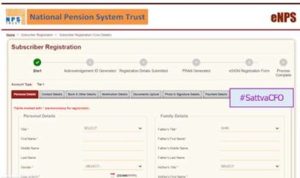

6. Fill up your personal information.

6. Fill up your personal information.

Many details will be prefilled in the form if Aadhaar is enabled. To create an acknowledgment number, click Submit.

7.Select a pension fund manager

7.Select a pension fund manager

Choose from eight different pension funds. National Pension Scheme – Open NPS Account.

8. Select an investing method

The equity allocation adjusts with age in auto mode. You choose the combination in active mode.

9. Select an investment combination

Specify how the fund will be divided among fund categories if you choose active management.

10. Make a list of your nominations.

Give the names and addresses of the persons who should inherit the money if the investor expires.

11.Upload a photo of yourself and your signature.

Upload a photo if you aren’t using Aadhaar. Otherwise, add your signature.

12. Contribute and get PRAN

Tier I requires a minimum of Rs 500, while Tier II requires a minimum of Rs 1,000.Net banking, credit card, and debit card are all options for investing.

You will be assigned a PRAN after your payment has been accepted.

13. Download your form

Please print the form, attach your photo, sign it, and submit it to the CRA office within 90 days.

How to open NPS Account Offline (Offline Registration Process)

Documents Required for Registration

Along with the application form, you must send copies of your identification evidence and proof of residency (Aadhaar card, ration card, passport, voter ID, driver license, etc.).

To establish an account offline, go to one of the PFRDA’s designated Points of Presence (POPs). POPs offer NPS services in the areas of departments known as POP Service Providers (POP-SP).

POPs are responsible for all NPS-related operations, from subscriber registration to changing investment schemes/fund managers to printing account statements.

Mostly all financial organizations have signed up as POPs, including banking institutions, insurance firms, and financial services firms.

FAQ’S

1.Is it reasonable to invest in NPS?

The National Pension System (NPS) has grown in popularity in recent years due to the excellent returns it generates. Unlike mutual funds, NPS does not provide investors a lot of investment and redemption freedom. On the other hand, experts feel that profits should not be the only motivation to invest in NPS.

2.What is the NPS calculator?

The NPS calculator will show you your investment data. It will show you the amount you invested during the scheme’s accumulation period, the interest you received, and the total amount of capital created at maturity.

3.Is it necessary to make a deposit every year on NPS?

Although no minimum annual contribution is required, it is advised that payment of at least Rs. 1000 be made to assure a sufficient pension after retiring.

Also read:

Leave a Reply