CFO’s are of great need today. In the age of huge conglomerates and start-ups pushing the boundaries of a global economic workforce, a systematic setup usually helps such entities grow for the greater good. In the present environment, a monopolistic attitude is not a great use. Companies tend to hire many such representatives who can offer individualistic support like a CFO. Virtual CFO Services SattvaCFO

Who is a virtual CFO?

A CFO or known as a Chief Financial Officer provides skilled financial assistance to an organization. They are of great importance to analyzing the different financial elements crucial to an organization’s progress. CFO’s embodies the main aspect of why a company makes a profit or stabilizes the flow of funds or any of those economical structures. But, what if a company doesn’t have a CFO? Start-ups usually go for such an individual known as a Virtual CFO. Today, the work-from-home situation has boosted the workforce ideology. You don’t have to hire them unless necessary. Funds and capital are important and hiring for a longer period could turn out to be a liability. Hence, outsourcing work to a CFO is very beneficial to such low-capital start-ups.

What does a Virtual CFO do?

A chief financial officer’s major responsibility in any corporation is to monitor financial planning, manage and report on financial activity, and manage financial risk. A virtual CFO provides the same services, but because their typical clients are small enterprises and startups, they are required to supply additional services. Virtual CFO services frequently resemble the financial hierarchy of needs. At its most basic level, a virtual CFO is supposed to act as the client’s accountant, with accountability for the correctness of the accounting records and the interpretation of financial data from financial information for the customer.

Smaller firms couldn’t afford a CFO’s strategic guidance until lately, because financial professionals preferred in-house, permanent jobs. Small and medium-sized organizations, for their part, have been hesitant to fill the seat since it’s impossible to predict when a scaling organization will be able for such a commitment. But, thankfully, times are changing, and small-business owners can now prioritize this service. It’s easy to see why today’s corporate leaders are upgrading from transactional accounting services to a CFO’s advising services: Executives now have access to more data than it has ever been.

What benefits do a virtual CFO offer?

A virtual CFO Service eliminates the geographical barriers. It allows companies and start-ups to reduce the burden of increasing their liability. Such liabilities account for salaries that CFO and other higher positioned authorities take the bigger piece of the cake. Hence, virtual CFO’s allow an easy and simply outsourcing of work in the most secure way. It reduces the time taken to start a mandate and also the resources wasted on the recruitment and selection process. Different virtual CFO’s offer different remuneration values for their work, hence you have the flexibility to choose the right CFO that fits your budget. Time is of the essence and virtual CFO’s can modify the result of labour as per your request. Virtual CFO Services SattvaCFO.

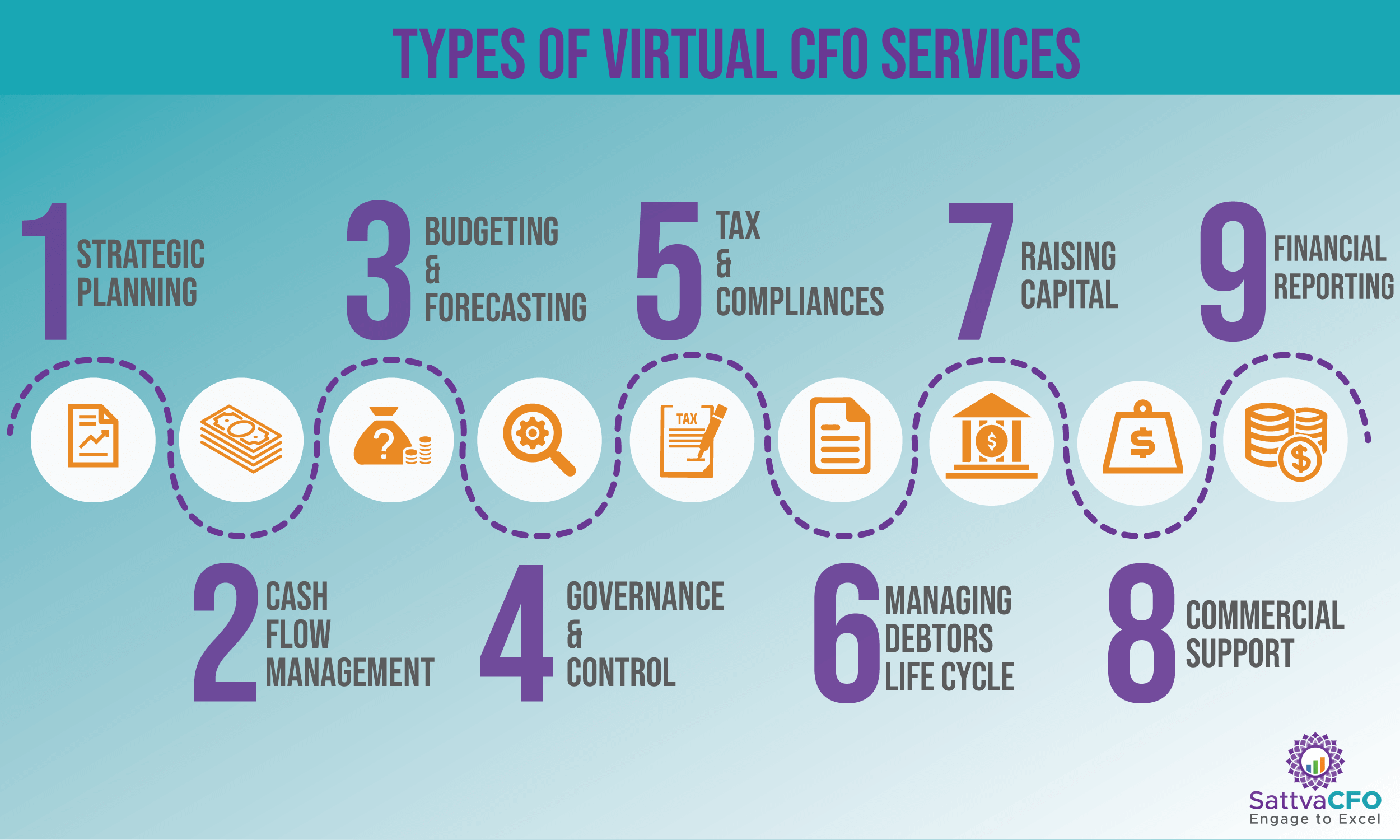

What are the various services managed by a virtual CFO team?

What are the various services managed by a virtual CFO team?

Just as how a local CFO provides systematic information related to company financials, A virtual CFO does the same in the given work style.

Financial Reporting: A virtual CFO provides accurate and systematic financial reporting of the company to the management and provides a deep strategic insight into the company’s current financial status and its goals. The CFO also ensures that the company motive isn’t spared from the current estimates.

Accounting Systems and processes: Using the best and right accounting tools and systems can engage the company to have accurate financial information. A good virtual CFO uses the best to analyze the right and accurate information for the company for better results. This involves understanding, identifying, evaluating, and implementing the best to the job.

Following up: A good Virtual CFO will follow the right protocols and internal control standards of the company. The CFO will make sure that such valuable data will never leak nor fall into the wrong hands. They will maintain the trust of the organization however far they are. Though, a good company will engage in strict NDA’s with whomever they hire but, the sole conscience of the CFO is very important.

How can a virtual CFO grow your company?

A virtual CFO can:

- Take charge of your financial needs so you don’t have to worry about who’s in charge of your accounting.

- Implement procedures to improve the efficiency of their accounting department.

- Implement cloud bookkeeping to give the company owner accessibility to their financial statements from any device, at any time, and from any location.

- Implement basic monitoring so that the owner is aware of the company’s performance.

- Examine accounting processes and procedures to ensure that the proper systems and procedures are followed for just a smooth accounting system.

- To aid in the monitoring of business performance, implement a reporting system that includes a KPI dashboard.

- Implement a financial forecasting model to make sure the company keeps on top of its cash flow in the face of growing expenses, and monitor it on a regular basis.

- Examine payroll adherence and make sure all records are in order.

What are the benefits of SattvaCFO’s virtual CFO services?

SattvaCFO engages closely with the client as their strategic business partner. With a full-fledged system that organizes your data and systems that provide accurate results, SattvaCFO ensures that the client knows their best move in the industry for better performance. We believe in the value of relationships and long-lasting partnerships. The unique standards and internal control procedures at SattvaCFO ensure the safety of the client’s record. Virtual CFO Services SattvaCFO

SattvaCFO provides Virtual CFO Services on a faster mandate. Please connect with us.